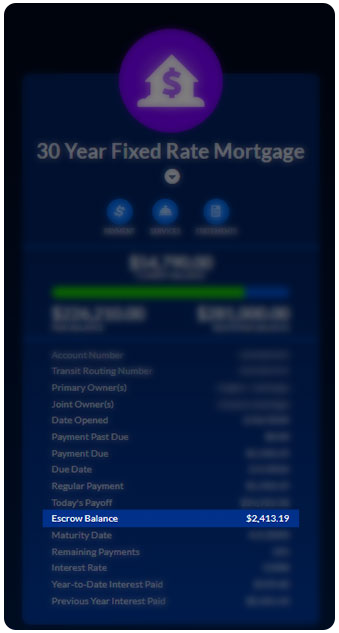

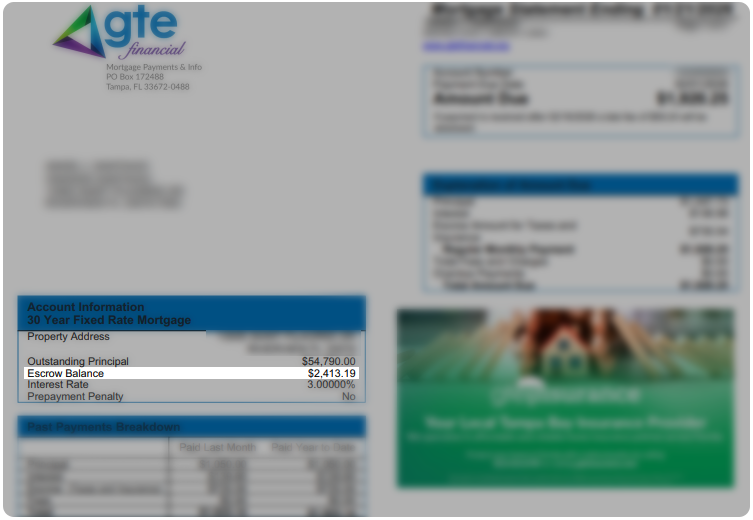

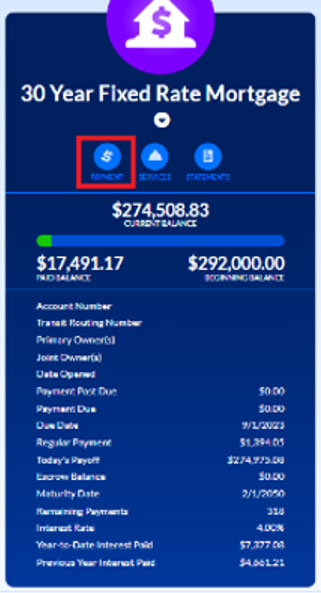

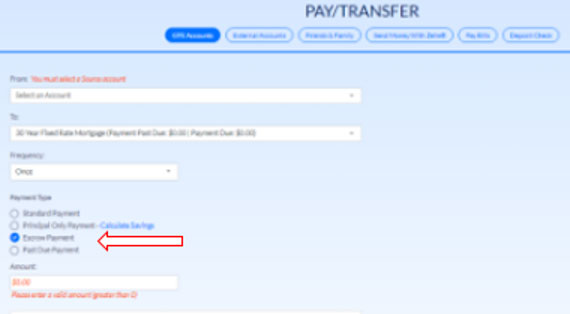

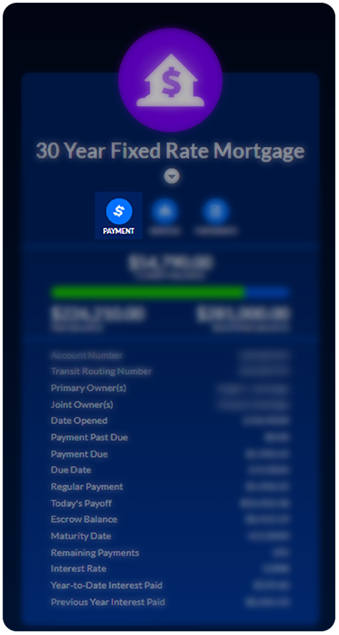

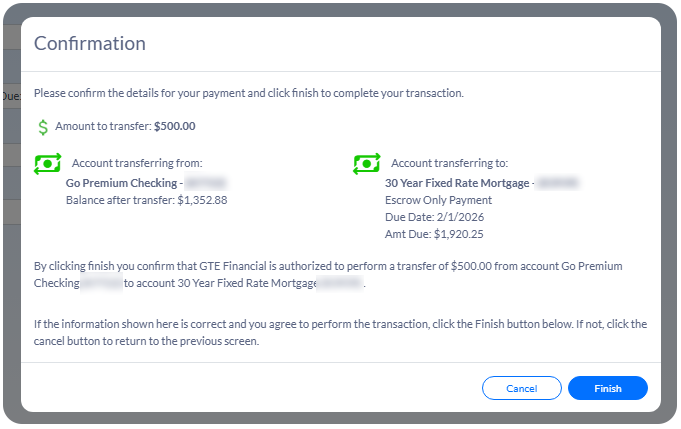

An escrow analysis ensures that there are sufficient funds in your account to cover upcoming insurance premium(s) and property taxes.

Due to recent challenges faced by the Florida homeowners insurance market, your next Escrow Account Disclosure statement might show a significant increase in your monthly escrow payment.